Certain types of life insurance especially term policies can be halal in Islam if structured to avoid riba, minimize uncertainty, and serve a genuine need, according to scholar Joe Bradford.

Bismillah!

Many Muslims wonder, "Is life insurance halal?" The answer isn’t simple, but according to leading Islamic finance scholar Joe Bradford, certain types of life insurance can be halal under specific conditions. In this article, we break down why Joe Bradford permits life insurance, what types he considers Shariah-compliant, and how his view fits into broader Islamic financial principles.

The Traditional Islamic View on Life Insurance

Traditionally, Islamic scholars have been cautious, often prohibiting conventional life insurance due to:

-

Riba (interest): Many life insurance policies invest premiums in interest-bearing accounts.

-

Gharar (excessive uncertainty): The policyholder may not get back what they paid, depending on when they die.

-

Maysir (gambling): Some argue insurance involves betting on life and death.

These concerns make many Muslims avoid life insurance altogether, fearing it contradicts Islamic values.

Joe Bradford’s View: A Balanced and Practical Approach

Joe Bradford, an American scholar with a background in both Islamic law and conventional finance, offers a more nuanced perspective. Here's why he believes some forms of life insurance can be halal:

1. Term Life Insurance Is Not the Same as Whole Life

Bradford emphasizes the difference between term life insurance and whole/universal life insurance:

-

Term Life Insurance: A policy that provides coverage for a fixed number of years (e.g., 10 or 20 years). If the insured person dies during that time, their beneficiaries receive a payout.

-

Whole Life Insurance: Includes a savings/investment component, often tied to interest (riba), and continues for life.

Joe Bradford supports term life insurance because it is simpler, transparent, and free of investment elements that involve riba.

2. Addresses a Real Need (Ḥājah) in the Muslim Community

Islamic law allows certain contracts when there's a valid need or hardship involved.

In many cases, life insurance protects a family’s financial future, especially when one spouse is the sole breadwinner. Bradford views this protection as a legitimate necessity (ḍarūrah or ḥājah), especially in places where no Islamic alternative (like takaful) exists.

3. Not Gambling, But Risk Management

Some critics argue that life insurance is maysir (gambling). Bradford disagrees.

“Insurance is not gambling. It’s a tool for risk mitigation,” – Joe Bradford

-

Gambling involves personal gain from chance.

-

Term life insurance involves planned contributions to protect others.

In essence, it’s about responsible financial planning, not making money off of risk.

4. Minimal Gharar (Uncertainty)

While every contract involves some uncertainty, Joe Bradford believes the level of gharar in term life insurance is small and does not invalidate the contract especially when the contract terms are clear and the premiums are fixed.

5. No Takaful? Use the Best Available Option

Islam encourages Muslims to use halal financial services whenever possible. However, in the U.S. and many other countries, Islamic takaful insurance is not widely available.

Bradford argues that in such cases, using a conventional term life insurance policy is permissible as the best available option, as long as it avoids riba and serves a clear protective purpose.

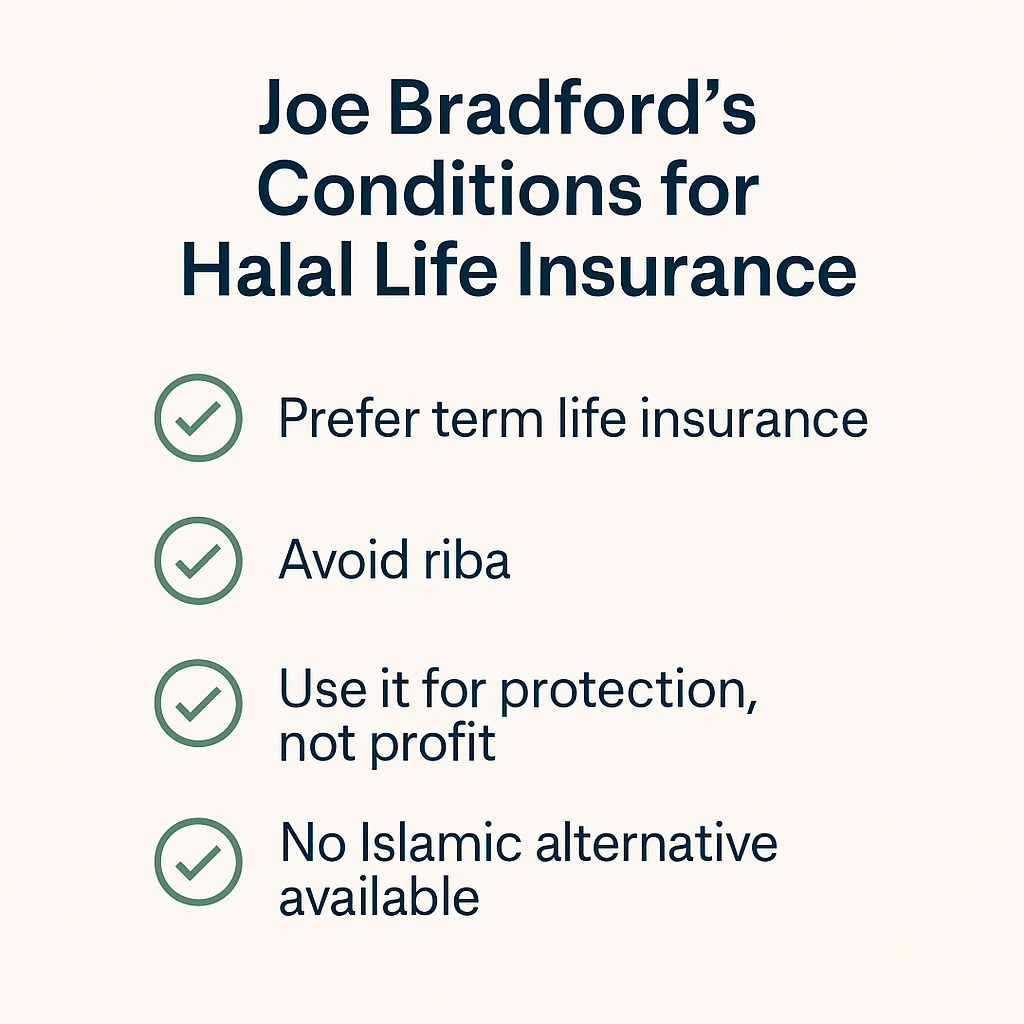

Summary: Joe Bradford’s Conditions for Halal Life Insurance

Joe Bradford permits life insurance if the following conditions are met:

Condition |

Explanation |

|

Prefer term life insurance |

Avoid whole/universal policies with investment elements. |

| Avoid riba | Ensure premiums are not invested in interest-bearing accounts. |

| Use it for protection, not profit |

The goal should be to support dependents, not to generate wealth. |

| Minimal gharar is acceptable |

Clear contracts with fixed premiums are key. |

|

No Islamic alternative available |

If takaful isn’t accessible, use the next best halal option. |

Still Not Sure? Consult a Scholar You Trust

While Joe Bradford offers a well-reasoned view, not all scholars agree. If you're unsure, it’s always best to:

-

Speak to your local imam or Islamic finance expert

-

Consider your intentions and financial situation

-

Choose policies that are simple, transparent, and protective

🛡️ Conclusion: Life Insurance Can Be Halal, but with Conditions

Joe Bradford provides a practical and balanced Islamic opinion on life insurance. According to him, term life insurance if structured correctly and used for the right reasons can be Shariah-compliant.

If you're a Muslim living in a non-Muslim country with no access to takaful, this view may offer a halal path to securing your family’s future inShaAllah.